Complete Cash Solutions offer:

Insured Cash Deposit (ICD) Program

High Yield Cash

High Yield Cash deposits are not eligible for 'householding' of platform fees.

| Cash in Account | Deposit rate6 | Annual Percentage Yield (APY)6 |

| $0.01 - $99,999.99 | 0.60% | 0.60% |

| $100,000 - $249,999.99 | 0.60% | 0.60% |

| $250,000 - $999,999.99 | 0.60% | 0.60% |

| $1,000,000 - $9,999,999.99 | 0.98% | 0.98% |

| $10,000,000 and over | 2.00% | 2.02% |

| Cash in Account | Deposit rate6 | Annual Percentage Yield (APY)6 |

| $100,000 - $249,999.99 | 3.50% | 3.56% |

| $250,000 - $999,999.99 | 3.75% | 3.82% |

| $1,000,000 - $9,999,999.99 | 3.75% | 3.82% |

| $10,000,000 and over | 4.00% | 4.07% |

Deposit rate and annual percentage yield for balances below $100,000 is 0.65%.

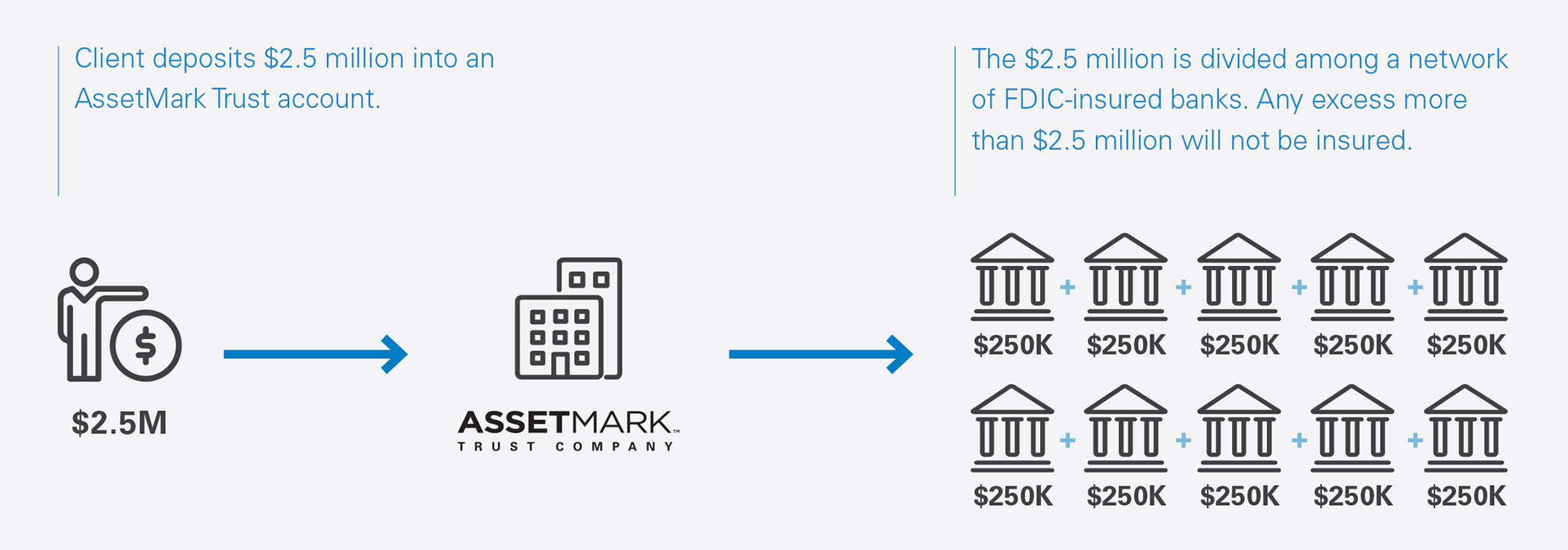

How Extended FDIC Insurance Works

Backed by the full faith and credit of the US government, FDIC protects against loss of deposits if an FDIC-insured bank or savings association fails, by providing insurance up to $250,000 per depositor and per insured bank, for each account ownership category.

FDIC-insured banks are selected based on stringent criteria including their overall financial health, stability and current standing with the FDIC.

| BANK NAME | BANK HEADQUARTERS | FDIC CERTIFICATE # | ABA ROUTING # |

| Amerant | FL | 22953 | 67010509 |

| AXOS Bank | CA | 35546 | 122287251 |

| Banc of California | CA | 35498 | 122243774 |

| Bank of Hope | CA | 26610 | 122041235 |

| Bank OZK | AR | 110 | 82907273 |

| Bell Bank | ND | 19581 | 91310521 |

| BMO Harris Bank | IL | 16571 | 071000288 |

| Centennial Bank | AR | 11241 | 082902757 |

| Citibank, N.A. | SD | 7213 | 021000089 |

| Citizens Bank, N.A. | RI | 57957 | 011500120 |

| City National Bank | CA | 17281 | 122016066 |

| Comerica Bank | TX | 983 | 121137522 |

| Customers Bank | PA | 34444 | 31302971 |

| EagleBank | MD | 34742 | 055003298 |

| Fieldpoint Private Bank & Trust | CT | 58741 | 021172784 |

| First Business Bank | WI | 15229 | 075905787 |

| HSBC | VA | 57890 | 022000020 |

| JPMorgan Chase Bank, N.A. | OH | 628 | 122100024 |

| KeyBank National Association | OH | 17534 | 041001039 |

| Metropolitan Commercial Bank | NY | 34699 | 026013356 |

| Morgan Stanley Bank N.A. | UT | 32992 | 021000089 |

| Morgan Stanley Private Bank N.A. | NY | 34221 | 031101305 |

| Peapack-Gladstone Bank | NJ | 11035 | 021205237 |

| River City Bank |

CA | 18983 | 121133416 |

| Sallie Mae Bank |

UT | 58177 | 124385119 |

| SoFI |

UT | 26881 | 121141398 |

| TriState Capital Bank | PA | 58457 | 043019003 |

| Umpqua Bank | OR | 17266 | 123205054 |

| U.S. Bank N.A. | OH | 6548 | 42000013 |

| Washington Federal Bank | WA | 28088 | 321181297 |

| Western Alliance Bank | AZ | 57512 | 122105980 |

1. The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. More information can be found at www.fdic.gov/deposit/deposits/

2. See the AssetMark Trust Company FDIC-Insured Cash Program Disclosure Statement and AssetMark Trust Company Custody Agreement for details and restrictions.

3. Exceptions apply. Accounts that are invested in a strategy over which AssetMark exercises some level of investment management or are Internal Revenue Code Section 403(b)(7) custodial accounts are not eligible to participate in the ICD program.

4. AssetMark Trust, at its discretion, may determine that your account, or a particular strategy held in your account, is ineligible to participate in the Insured Cash Deposit Program.

5. Insured Cash Deposit Program and High Yield Cash collectively provide up to $2.5 million of FDIC insurance.

6. Clients need to have a High Yield Cash account to get the rates indicated. Rates for High Yield Cash are negotiable. The deposit rates and annual percentage yields are variable and may change at any time at our discretion. They are effective as of the date shown above. Interest on the account will be compounded on a monthly basis.

7. This list is subject to change. ICD Program banks may be excluded from receiving program deposits in the event that total assets at a program bank (including assets that are held with the bank outside of AssetMark Trust's Complete Cash Solutions Program) exceed the FDIC insurance limits. It is your obligation to monitor your account(s), your FDIC coverage and your FDIC insurance eligibility. See www.fdic.gov for more details regarding FDIC coverage. For more information on AssetMark Trust's FDIC-Insured Cash Program, please refer to the AssetMark Trust Company FDIC Insured Cash Program Disclosure Statement. If you would like to opt out from certain program banks, please speak to your advisor.